In need of a comprehensive online payments solution for your company? When starting a business, this is a key thing to get right. A growing number of merchants have used Stripe to streamline the payment process for their online stores.

Read this post to learn about how does Stripe work and how to implement it in your online store.

What Is Stripe?

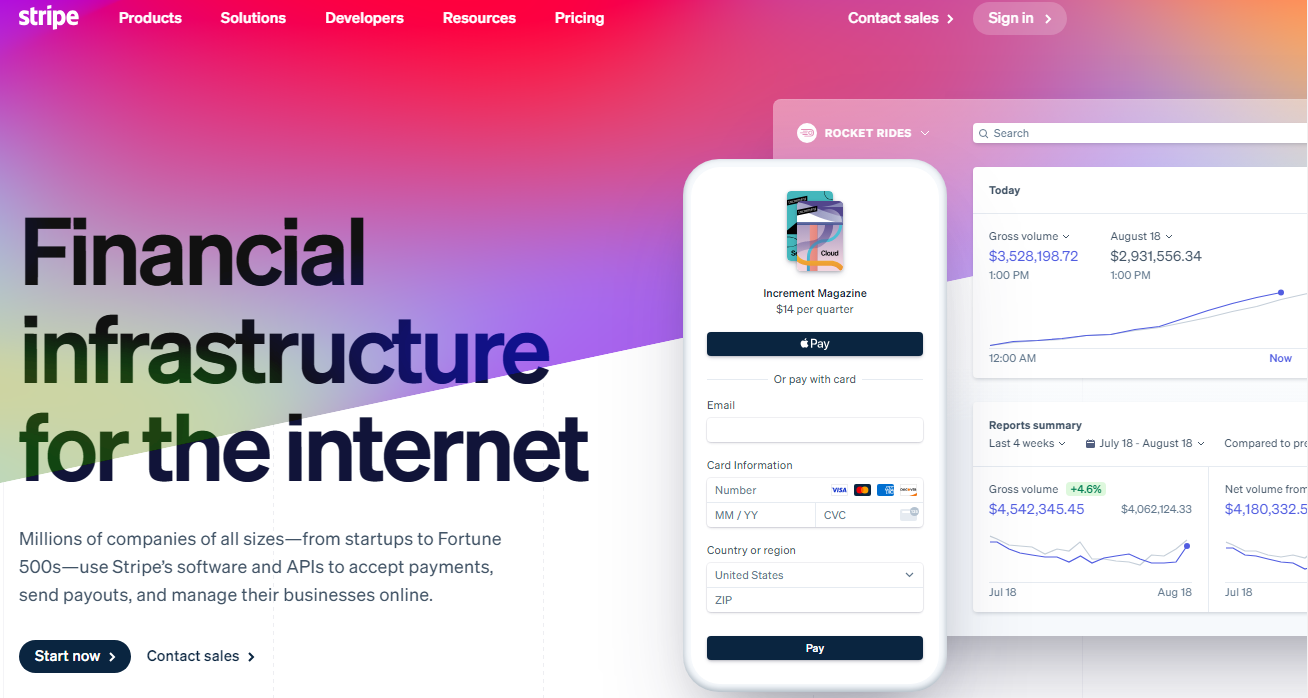

For companies to accept credit card payments online, they may use Stripe.

Stripe is a credit card processing platform that facilitates money’s secure and speedy movement directly from a buyer’s credit card or bank account to the seller’s bank account.

Stripe is the easiest and most convenient software to accept online card payments since it serves as a payment processing platform and credit and debit cards payment gateway using the customer’s bank account.

Is Stripe a Merchant Account?

Stripe is not a traditional supplier of merchant services. Stripe is a PSP or payment service provider aiming to process payments on your behalf via a third party. Many consumers may not even distinguish between a merchant account and a payment service provider.

But Stripe users don’t have separate merchant accounts. Instead, they combine their separate accounts into one giant merchant account. Please refer to our section explaining the nature of a payment service provider for more clarification.

How Does Stripe Work?

Stripe is unique in that it is explicitly built with programmers in mind. This might make Stripe seem daunting to the ordinary user unless they use a version already integrated into a service like Shopify.

The positive side is that Stripe is very configurable and well-documented for developers. Take a look at this example of a successful credit card transaction.

How to Set Up a Stripe Account

- Register

The first step to being able to accept payments online or subscription payments is to create your merchant account. Go to the Stripe website and choose the “Start Now” button to initiate your first transaction with Stripe Payments.

You’ll need to enter your email address, complete name, and nationality on the “Create Your Stripe Account” page. You will also need a password.

Click the verification link in Stripe’s email to confirm your email address. Get started with Stripe by filling out the needed fields. Include a description of your company, specifics on how orders will be fulfilled, access credentials for your business bank account, and a copy of your most recent credit card statement. You can also enable two-factor authentication.

When you activate your account, you will get an email. It may take up to 24 hours for the verification to be completed.

Be truthful about your company and the items or services you provide since Stripe employs a fast approval procedure.

- Include Stripe Into Your Ecommerce Website

To utilize Stripe’s REST API, you’ll need two sets of keys: one for development and one for production. Your API keys are located in your Stripe dashboard’s “Developers” section. After you have set up your account, you can switch between the Live and Test keys.

In particular, Stripe aims to operate with common server-side languages and frameworks. Stripe requires minimum effort to set up. With a ready-made solution like Stripe Checkout, you must copy and paste some code onto your website.

- Conduct a Mock Trade

To verify the proper operation of your account, you may generate test payments from the “Payments” section of your dashboard.

You will need to install the Stripe library compatible with your programming language if you want a more tailored solution that involves writing code. The npm and pip package managers, among others, make this possible for certain languages.

The next step is configuring your API keys and constructing an object representing your payment intent, complete with fields for the transaction’s amount, currencies, payment method, and the recipient’s email address. Stripe will send back an object with the relevant information if the transaction is successful.

- Start the Processing

The “Balances” part of your account displays your current balance, including incoming and outgoing money and any holds placed on those funds. While you may start taking payments immediately, Stripe won’t release them until you validate your account. On average, the procedure takes seven days.

Remember that Stripe isn’t limited to processing online credit card payments. Invoicing, ACH payments, foreign payments, and even in-person transactions are all possible with Stripe. Some of these functions are free with your basic account, while others will cost you extra money on top of your normal transaction charge.

Anti-Fraud Measures by Stripe

Suppose a problem arises during payment (such as insufficient money in the buyer’s account). In that case, Stripe will not execute the transaction, and the consumer will have to try another payment option.

Moreover, Stripe keeps an eye out for fraudulent transactions and immediately cancels any that seem fishy.

Setting spending limits and card merchant controls is a good place to start if you want to protect your company from fraud.

Secure Payment Gateway

Stripe is widely sought after by online businesses due to its reputation for providing top-tier security. It also provides some of the best software applications in the payment processing industry.

If a small company owner considers adopting Stripe, you should know that many large corporations also rely on Stripe. Lyft, Amazon, Shopify, and Pinterest are some major companies that utilize Stripe.

You can use Stripe to accept online credit or debit card payments since most customers prefer it for processing payments.

Can You Get the Most Out of Stripe for Your Company?

If you’re a business that takes payments online and your customers like using credit cards, Stripe might be a good choice. It can also be helpful if you work as a contractor and want to automatically process customer payments for regular, reliable deposits into your bank account. Stripe makes it easy for businesses of any size to accept credit card payments.

Stripe |

|

Final Thoughts

In conclusion, Stripe is a payment service provider that allows companies to easily accept credit card payments online. You can easily integrate it into an e-commerce website through API keys and ready-made solutions like Stripe Checkout.

Setting up a Stripe account is a simple process. Once it is set up, businesses can easily process payments and track their transactions through the Stripe dashboard. Stripe is a convenient and secure option for businesses looking to streamline their online payment process.

Frequently Asked Questions

What Is Stripe, and What Does It Do?

Stripe is an online payment processing platform that allows businesses to accept payments securely over the internet. It enables transactions through credit cards, debit cards, and other payment methods.

How Does Stripe Facilitate Online Payments?

Stripe acts as the intermediary between the merchant’s website or app and the customer’s payment method. When a customer makes a purchase, Stripe securely collects and processes the payment information.

What Steps Are Involved in a Typical Payment Process Using Stripe?

When a customer enters their payment details on the merchant’s website, Stripe encrypts and securely transmits the data to the respective financial institutions for authorization and processing.

Paul Martinez is the founder of EcomSidekick.com. He is an expert in the areas of finance, real estate, eCommerce, traffic and conversion.

Join him on EcomSidekick.com to learn how to improve your financial life and excel in these areas. Before starting this media site, Paul built from scratch and managed two multi-million dollar companies. One in the real estate sector and one in the eCommerce sector.