Stripe is a payment processing company that allows businesses to accept payments via credit cards or bank transfers. Stripe has become the de facto standard for accepting payments online. Does Stripe have competitors?

Stripe was founded in 2011 by brothers Patrick and John Collison. They wanted to create a simple way for companies to accept payments from customers. The founders had previously worked at PayPal where they saw firsthand how complicated it was to run a successful eCommerce site.

Stripe offers a free service called Stripe Connect. This lets you connect your existing merchant account to Stripe. If you already have a merchant account with another processor, you can also integrate Stripe into your current system.

Still, if you’re currently planning on opening up your very own online business (or you want to use a payment processor provider for another reason) you might currently be wondering if there are any alternatives out there that might be better suited to you and your company.

This is where we come in to lend a helping hand. In this article, we are going to be providing you with a breakdown of what Stripe offers, as well as what competitors it currently has.

This will help you to ultimately decide which payment processor provider is going to be the best for you and your needs. So, whenever you’re ready, just read on!

What Is Stripe?

Stripe |

|

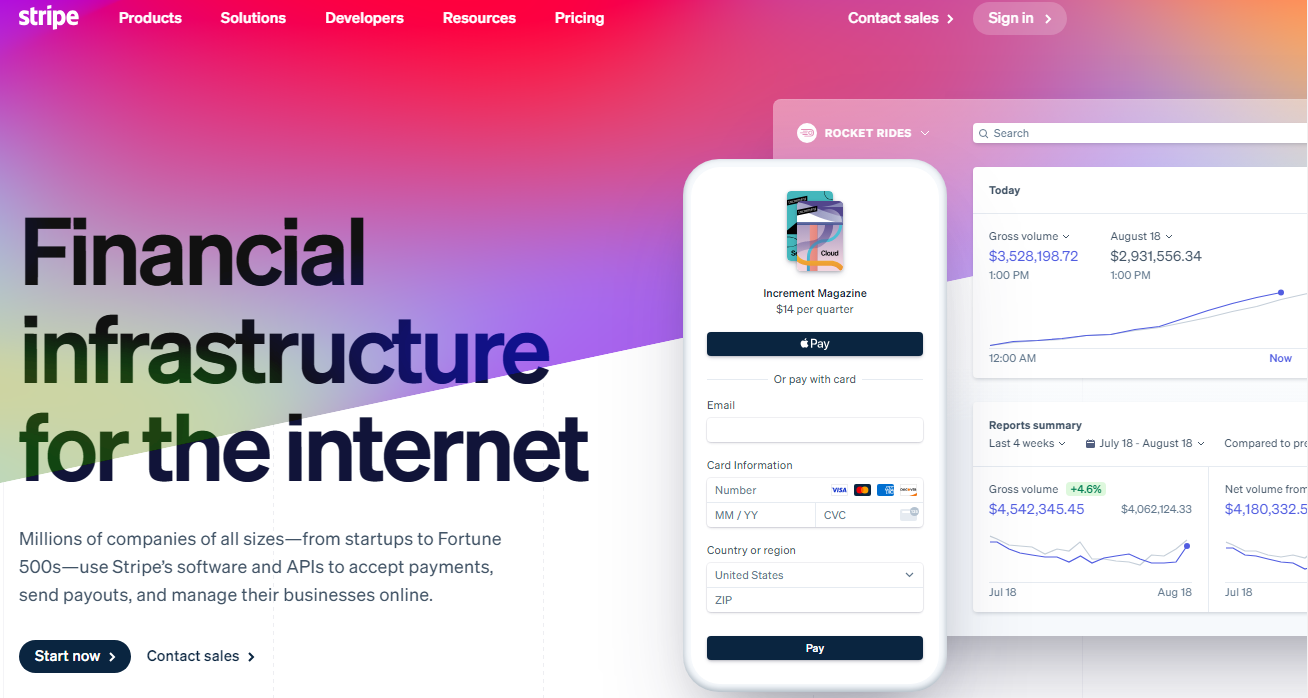

If you’ve ever heard of Stripe before, you’ll know that it’s an online payment processing platform that makes it easy for small businesses to accept payments through their website. The idea behind Stripe is pretty straightforward: it’s designed to make it easier for people who sell things online to get paid.

It does this by allowing them to set up an online store without having to worry about all the technical details involved. The basic premise behind Stripe is that it helps small businesses grow by making it easy for them to accept payments.

How Does Stripe Work?

When someone wants to pay for something using Stripe, they simply visit their website and enter their card information. Once the transaction is complete, Stripe takes care of the rest.

Once a customer submits their card information, Stripe checks whether their card is valid and then charges the amount of the purchase against their card. After the charge is completed, Stripe sends the customer an email letting them know that their order has been processed.

This means that once the customer receives the confirmation email, they can go ahead and check out. If they choose to do so, they can either click “Pay Now” or “Continue Shopping.” Either option will take them back to the checkout page where they can review their order and finalize their purchase.

Is Stripe Better Than Other Payment Processors?

At first glance, Stripe looks like a great alternative to other payment processors. However, when you dig deeper, it becomes clear that it doesn’t offer anything particularly unique.

Sure, it’s free, but this isn’t exactly a selling point since most other payment processors offer a similar service. It’s not really cheaper than other providers either.

While it may seem like a good deal at first, the fact remains that you still need to sign up for a monthly fee.

It’s also worth noting that while Stripe is available in over 45 countries around the world, it only supports credit cards from the US, UK, Canada, Australia, and New Zealand.

These are all fairly standard limitations, though, and shouldn’t stop you from considering Stripe. Still, if you’re looking for a payment processing provider that provides more flexibility, you should consider some of Stripe’s current competitors, as one of them might be a better fit for you.

Let’s check them out below:

Does Stripe Have Competitors?

Braintree

Braintree is another popular payment processor that allows customers to process transactions via their website. Braintree offers many of the same features as Stripe, including the ability to process both credit and debit cards. However, there are some key differences between the two services.

For example, Braintree requires users to have a merchant account with them. This means that users must already have a bank account in order to use Braintree.

PayPal

PayPal is probably the best-known name in the industry right now. They’ve got a huge user base, which makes sense given how much money they’ve made off of its success.

While they don’t provide any sort of payment processing service themselves, they do offer a number of different APIs that developers can use to build their own applications.

Square

Square is a company that specializes in mobile payments. It was founded by Twitter CEO Jack Dorsey, who wanted to create a way for people to pay using their smartphones.

Square works similarly to PayPal in that it lets users make purchases through their websites without requiring them to register with the site beforehand.

Amazon Payments

Amazon Payments is a subsidiary of Amazon that focuses on providing payment solutions for online retailers.

Amazon Payments has been around for quite a while, and it’s used by a wide range of companies, including Netflix, JetBlue, and even the United States Postal Service.

Google Wallet

Google Wallet is a new service developed by Google that lets users pay for items using their phones. Google Wallet uses NFC technology to let users tap their phone against an NFC reader to complete a transaction.

Authorize.net

Authorize.Net is a well-known payment gateway that’s been around since 1994. Authorize.Net is great because it doesn’t require a separate merchant account or anything else. All you need to get started is a valid business email address and a bank account.

Braintree |

| |

PayPal |

| |

Square |

| |

Amazon Payments |

| |

Google Wallet |

| |

Authorize.net |

|

Final Thoughts

So, there you have it! That’s a quick look at five alternatives to Stripe. If you want to learn more about each option, feel free to do some more research to figure out which one might be the best option for you, your budget, and your business.

Frequently Asked Questions

What Is Stripe, and What Does It Offer as a Payment Gateway?

Stripe is a popular online payment processing platform that allows businesses to accept credit and debit card payments, as well as other payment methods, on their websites or mobile apps.

Are There Other Payment Gateways That Compete With Stripe?

Yes, there are several other payment gateways that compete with Stripe, offering similar services and features. Some of the notable competitors include PayPal, Square, Braintree, Authorize.Net, 2Checkout, and Adyen.

How Do These Competitors Compare to Stripe in Terms of Fees?

Competing payment gateways may have different fee structures, including transaction fees and monthly fees. It’s essential to compare the pricing to determine the best fit for your business based on your transaction volume and needs.

Paul Martinez is the founder of EcomSidekick.com. He is an expert in the areas of finance, real estate, eCommerce, traffic and conversion.

Join him on EcomSidekick.com to learn how to improve your financial life and excel in these areas. Before starting this media site, Paul built from scratch and managed two multi-million dollar companies. One in the real estate sector and one in the eCommerce sector.